About Us

OUR STORY

SHIFT CAPITAL is an independent financial advisory firm specialising in the institutional and professional real estate sector.

Founded in 2012, the firm was created to leverage the experience of its founder in structured real estate finance — both as a lender within leading investment banks and as a borrower on behalf of institutional investment funds — to serve a diverse clientele of institutional and private investors, developers, asset managers, and lenders.

Since inception, SHIFT CAPITAL has advised on more than 150 transactions, representing over €6 billion of capital, across a wide range of structuring, fundraising, and financial restructuring mandates.

We have been active in Germany since 2020 and in Italy since 2022.

Shift Capital is registered with ORIAS as a Credit Broker (COBSP) and is a member of CNCEF Crédit, a professional association accredited by the ACPR.

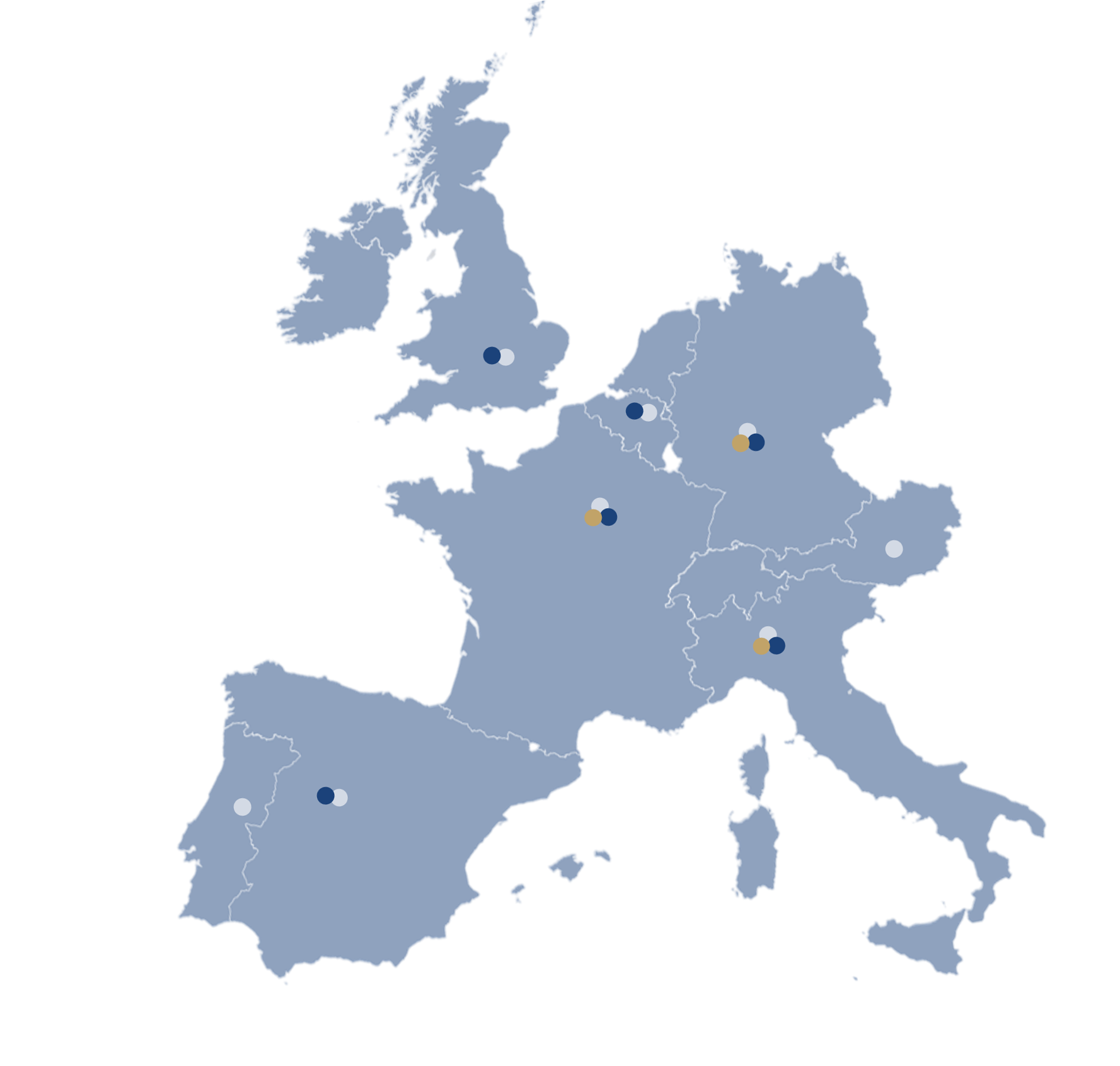

Our activity is primarily focused on Western Europe, with a strong presence in France, Germany since 2020, the Benelux, Italy since 2022, Spain, and the French overseas territories, where our team benefits from deep local roots and in-depth market knowledge

-

Local presence

-

Shift Capital Track Record

-

Managers Track Record

Our Mission

At SHIFT CAPITAL, our mission is to provide independent, high-value financial advice to real estate professionals by designing and executing tailored financing and capital structuring solutions that unlock value, mitigate risk, and support long-term growth.

We act as a bridge between investors, developers and lenders, with a rigorous approach rooted in strategic insight, market expertise and seamless execution.

Engaged at every stage of the investment cycle, we are committed to protecting our clients’ interests over the long run, from strategic planning to execution and beyond

Our Vision & Values

Our ambition is to be the trusted financial advisor of choice for real estate professionals across Europe — recognised for our independence, operational excellence, and ability to structure complex, high-impact solutions.

We are guided by five core values that underpin every assignment we undertake:

- Independence – Transparent, unbiased advice fully aligned with our clients’ interests

- Excellence – A high standard of technical and strategic rigour in everything we do

- Integrity – Trust-based relationships built on reliability, transparency and respect

- Entrepreneurial Mindset – Creativity, agility and commitment in solving complex challenges

- Results-Driven Culture – End-to-end support to ensure disciplined and effective execution

These principles form the foundation of our commitment to investors, developers and lenders — driving long-term performance and building enduring partnerships