Services

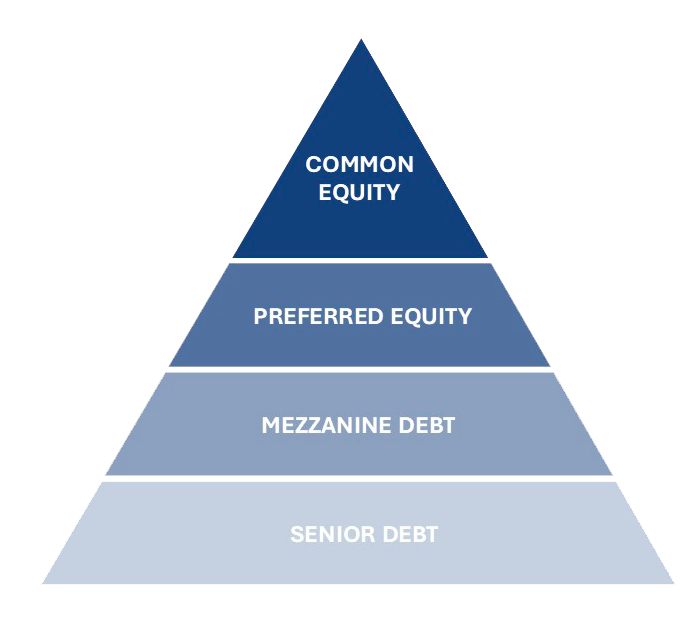

SHIFT CAPITAL operates across the entire value chain of financing and capital structuring, delivering tailored solutions in senior, junior and mezzanine debt, structured equity, special situations, restructurings, and loan portfolio sales.

Priority

DEBT ADVISORY

We advise borrowers on structuring and raising debt in the context of acquisitions, development, refinancing, and financial restructuring

We structure and coordinate club deals involving both banks and alternative lenders, and design transactions that combine multiple layers of the capital stack (senior, mezzanine, and/or preferred equity), including the negotiation of intercreditor agreements.

Our involvement spans from the initial structuring and modeling phase, through the marketing and heads of terms negotiation stages, to the negotiation of the credit documentation.

Our expertise covers all commercial and block-residential real estate asset classes, including office, retail, industrial, logistics, hospitality, healthcare, data-centers and leisure.

EQUITY ADVISORY/M&A

We help developers and operating partners to find and structure partnerships with capital providers across a wide range of projects. The structures we implement include joint ventures, equity placement, minority or majority interest acquisition or disposal, and other bespoke partnership arrangements

We advise on various types of transactions, including core to opportunity investments, development and redevelopment projects, acquisition of assets, loan portfolios or corporate structures, as well as secondary shares of club-deals or funds.

Our extensive network of institutional investors , private equity funds and family offices—combined with strong structuring capabilities and deep knowledge of JV and operating partnership models—allows us to match the right financial partner to the right project, under the most suitable structure.

RESTRUCTURING

We help borrowers and lenders to readapt financial resources to business plan evolutions

Acting as a trusted third party on crisis recovery business plans and strategic aspects, we help borrowers identify rescheduling, resizing, and additional capital contribution solutions for operations that face challenges or strayed from their original business plan.

We work in partnership with the specialised legal teams of our clients.

Our strong network of mezzanine, preferred equity and recapitalization funds allow us to seek the right external capital when needed to ensure the long-term sustainability of a transaction.

LOAN SALES/REGULATORY CAPITAL SOLUTIONS

We provide strategic advisory services for financial institutions in loan portfolio disposals, regulatory capital structuring, and balance sheet optimization, helping clients achieve regulatory compliance and enhanced capital efficiency

Our large network of specialized investors allows us to advise sell-side or buy-side on Performing Loans (PL), Unlikely to Pay positions (UTP) or Non-Performing Loans (NPL) transactions, as well as synthetic structures such as CRT/SRT.

STRATEGIC ADVISORY

We undertake targeted advisory mandates where our expertise in real estate investment and finance creates tangible value for our clients

We assist in defining investment and lending strategies, and provide support on organisational matters, pricing, and the identification and selection of partners — including local operators for origination, asset management, and servicing.

We also advise on complex sale processes, from buyer sourcing and documentation review through to transaction execution and closing.

Our extensive pan-European network across all areas of real estate investment and finance, combined with the transactional expertise and cultural fluency of our team, enables clients to establish and expand their business efficiently and with confidence.